What's New in Coal Power Innovation?

Despite a dismal outlook for coal, countries with substantial coal fleets are intensifying efforts to develop new technologies and operational capabilities to improve coal power’s environmental impact, efficiency, flexibility, and costs.

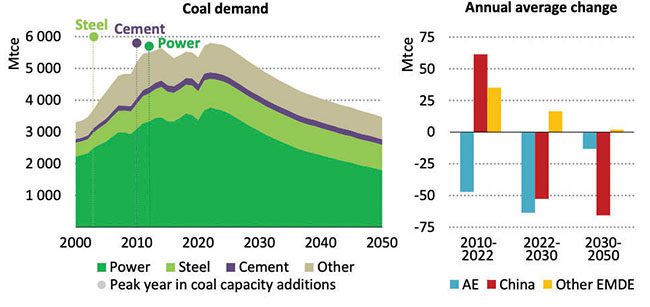

In 2022, global coal-fired generation reached an all-time high for the second year in a row, a resurgence driven by high natural gas prices stemming from the Russia-Ukraine conflict, extreme weather events, and other factors. According to the International Energy Agency (IEA), coal-fired generation set a new global record high of 10,440 TWh, representing about 36% of the world’s power generation. In the coming years, that trajectory may resume a downward turn for coal, driven by environmental scrutiny and economic pressures (Figure 1).

Still, the agency suggests, the world’s most carbon-intensive fossil fuel may—for some years yet—continue to account for more than one-third of total generation. And while investments in coal power have seemingly dried up of late—and many entities that currently run (and partly rely on) coal power appear to dismiss the long-term operation of their assets—innovation in coal power is still flourishing.

|

|

1. Global coal demand by sector and annual average change by region, 2000–2050. According to the International Energy Agency’s (IEA’s) Stated Policies Scenario (STEPS), peaks in coal capacity additions reached in the power, steel, and cement sectors are laying the foundation for global coal demand to peak in the mid-2020s. Mtce = million tonnes of coal equivalent; AE = advanced economies; EMDE = emerging market and developing economies. Source: IEA |

While several countries have pledged to phase out their coal fleets, many that plan to continue operating their existing coal plants and build new coal capacity include economies in the Asia Pacific Economic Cooperation (APEC). “This situation exists for a variety of reasons, including domestic and local politics and limited energy resource endowments (especially using natural gas as a transition fuel), along with energy and/or environmental policies, which include perceived positive benefits of employment and high wages in their coal and power sectors and the reliability and security of coal-based power generation,” the alliance notes.

But far from retaining a fleet of conventional coal plants, many countries in the alliance are pursuing a range of state-of-the-art technologies and operating practices that minimize fuel consumption and pollutant discharges, reduce water usage, and overall reductions in construction or operation costs. These include switching or co-firing lower carbon fuels in existing coal units, such as natural gas, ammonia, and hydrogen, and solids, like biomass and wastes. Notable efforts are also underway to retrofit existing coal plants with carbon capture, utilization, and storage (CCUS).

China’s Innovative Coal Plants

In China, the power sector accounts for more than 60% of coal use today, and coal power made up more than 60% of its total electricity generation in 2022. A complex mix of practical necessity, environmental responsibility, and economic strategy drives the country’s pursuit of new technologies. China, notably, has set down ambitious goals to achieve a peak in emissions before 2030 and become carbon neutral by 2060. Yet, China’s National Development Reform Commission (NDRC) has earmarked 200 GW of coal capacity to support its rapid rollout of new renewables. In 2022, it reportedly permitted 106 GW of new coal power projects, though it underscored that new coal plants should support grid stability and the integration of variable energy. According to the China Electricity Council, that has meant running the country’s coal fleet flexibly, with an average utilization rate that inched down to 52.4% in 2022.

At the same time, the country has implemented regulatory and market-based measures to monitor and manage energy production and use. A national emissions trading system (ETS), launched in 2021, involves an output-based allowance allocation and benchmark system designed to increase the efficiency of existing coal power plants by incentivizing their investments in low-carbon technologies or burning higher-quality coal. “In the long term, the ETS will motivate stakeholders to shift their investments to supercritical and ultrasupercritical [USC] plants rather than the traditional ones,” researchers from Tsinghua University in Beijing noted in a recent study.

Market conditions have prompted several noteworthy coal plants’ development and eventual implementation. Recent additions include Shenergy’s Pingshan Phase II, a cutting-edge 1.35-GW USC coal-fired unit, which achieves a net efficiency of 49.37%—making it the world’s most efficient coal-fired power plant. Meanwhile, in 2020, Shenergy boosted the efficiency of a 320-MW subcritical coal unit, Xuzhou Unit 3, to beyond 43.56%—higher than all existing Chinese supercritical units and even many USC units. That same year, Shenergy started up two 1-GW advanced supercritical units at the Caofeidian power station in Hebei Province, which integrate desulfurization and dedusting, as well as primary and secondary measures, to better guarantee “ultra-low emissions” of the project.

Among China’s noteworthy research and development (R&D) initiatives are a pilot plant installed at a 1-GW coal plant to assess combined selective catalytic reduction (SCR)–electrostatic precipitator (ESP)–wet flue gas desulfurization (WFGD) technology. Efforts to advance co-firing are also ongoing. In 2022, China Energy Investment Corp. announced it successfully demonstrated co-firing 35% ammonia with coal at pilot tests in a 40-MW coal boiler at the Huaneng Yantai coal power plant, with NOx emissions that were reportedly lower than burning pure coal fuel. In June 2023, meanwhile, the coal power giant launched a 500,000 ton/year CCUS facility at the Taizhou coal-fired power plant in Jiangsu province (Figure 2), making it the largest coal-fired CCUS project in Asia.

“Next, Taizhou Power Plant will join hands with related enterprises, universities, and research institutions to conduct research in fields such as the production of methanol with carbon dioxide and hydrogen and refined chemical products so as to enhance the value of carbon dioxide, further facilitate the full-cycle carbon industrial chain from capture to utilization, and accelerate the transition of coal-fired power CCUS from technological demonstration to industrialized, clustered development,” the company said.

|

|

2. China Energy says its Taizhou 500,000-ton carbon capture, utilization, and storage (CCUS) facility made breakthroughs in high-performance absorption tower packing and high-efficiency amine recovery. The project captures carbon, compresses it, converts it to liquid carbon dioxide with a purity of more than 99.5%, and then transports it to a storage tank through pipelines. Courtesy: China Energy |

India Boosting R&D Efforts

In India, the quest for better coal power generation stems from its energy strategy, shaped by an imperative to balance the country’s burgeoning energy demand with environmental considerations. According to the Ministry of Power, coal and lignite comprised 51% of installed capacity but generated more than 70% of its total power in 2022. India is targeting a share of 50% renewables in its power mix by 2030, and it has required 81 coal plants to reduce their power generation by 58 TWh over the next four years. However, it does not plan to announce retirements or repurposing of its 172 grid-connected coal power plants before 2030. Instead, the country’s biggest utilities, like NTPC, suggest a more gradual approach focusing on enhancing efficiency and reducing emissions.

That includes the adoption of supercritical and USC technologies. In 2019, state-owned NTPC started up its first-ever USC coal plant at the two-unit 1,320-MW Khargone plant in Madhya Pradesh. Earlier this year, Indian independent power producer Adani Power began operating the 1.6-GW Godda Ultra Super-Critical Thermal Power Plant. The project in Jharkhand state, India’s first commissioned “transnational power project” to supply 100% of its generated power to Bangladesh, is also India’s first to have 100% flue gas desulfurization (FGD), SCR, and zero-water discharge, Adani Power said.

Among other notable environmental equipment milestones the country has recently marked, NTPC commissioned the country’s first supercritical plant equipped with an air-cooled condenser in March. The effort, which tackles water scarcity paired with sustainability initiatives, stems from NTPC’s pronounced R&D initiatives and a concerted environmental, social, and governance (ESG) strategy, which envisions a more sustainable outcome for the company’s 70-GW fleet (which includes 26 coal-fired power plants with a combined capacity of 51 GW). NTPC in 2022 also kicked off carbon capture at its largest coal plant, the 4.8-GW Vindhyachal Super Thermal Power Station, a project that will also comprise a hydrogen generation unit equipped with a high-temperature steam electrolysis (HTSE) system to generate 2 tonnes per day of hydrogen, as well as a methanol production unit that will convert the CO 2 to methanol through a catalytic hydrogenation process.

But India is in tandem making concerted gains to develop new tools to achieve improved operational flexibility. Recognizing the frequency and severity of cycling coal units as the world ramps up its renewables and to match grid demand, the effort seeks to identify and prioritize actions—including different procedures and condition-based maintenance—needed to improve coal unit flexibility to avoid costly unplanned repairs. In October, the U.S-based Electric Power Research Institute (EPRI) recognized an NTPC-developed flexibility assessment tool with a “Technology Transfer” award for solving a problem “of size and significance.” The public-domain tool, which includes high-level assessment templates, provides operators with a systematic approach to evaluate existing coal power plants by identifying technical issues and obstacles impeding flexible operation.

Efficiency a Paramount Driver for U.S. Coal Power Innovation

In the U.S., where an average of 9.5 GW of coal capacity has been retired each year for the past decade, older and less efficient units are primarily grappling with higher operating and maintenance costs. Research priorities outlined by EPRI’s Program 223, a dedicated thermal power plant research initiative, strive to develop solutions that can be applied to solve a variety of flexibility and efficiency needs to deliver an optimized generation fleet. The program offers a comprehensive approach that reflects a nuanced understanding of the complexities of extending the life and performance of existing coal-fired power plants while steering the industry toward a sustainable energy future.

The program’s many efforts are focused on enhancing heat rate and operational flexibility, including tackling problems with bypass valves, which negatively affect heat rate through losses and excessive sprays, resulting in some equipment failures. As in China and India, the program is also focused on coal power’s shift toward cyclic coal unit operations, with efforts geared toward improving performance at part loads. These include cycle isolation evaluations to minimize steam and water leakages. In addition, the program is tackling challenges related to high-energy piping for enhanced flexibility and potential storage integration options. Pre- and post-outage testing, dispatch optimization, and advancements in cooling systems are also on the agenda. Innovative approaches, for example, include using infrared cameras on drones for heat transfer inspections.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).